In the high-stakes world of Mergers and Acquisitions (M&A), success hinges on the ability to make informed decisions quickly and execute flawlessly. Yet, the complexity of integrating two distinct organizations often leads to unforeseen challenges, missed opportunities, and unrealized synergies. Enter Choral Systems, a game-changer in the M&A landscape that’s redefining how businesses approach operational integration and value creation.

The M&A Data Dilemma

Traditional M&A processes are plagued by fragmented data and siloed analytics. Picture this: spreadsheets scattered across departments, incompatible systems between the acquirer and acquiree, and critical insights lost in the noise. This fragmentation isn’t just inconvenient—it’s a significant barrier to realizing the full potential of an M&A deal.

Key challenges include:

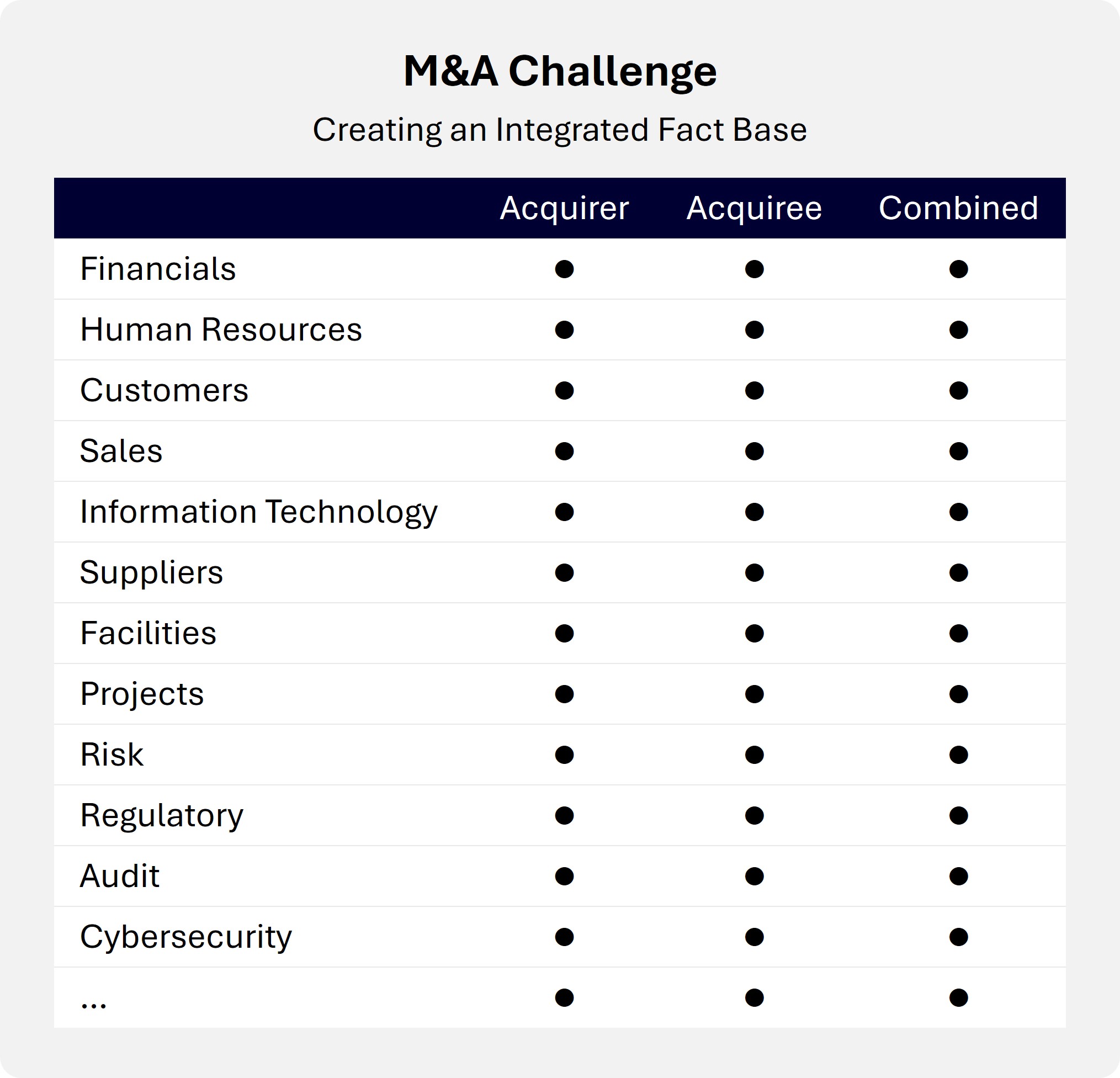

- Synergy Quantification: Accurately estimating potential benefits is crucial. Overestimation can lead to unrealistic expectations and operational setbacks, while underestimation might result in missed opportunities. For example, quantifying cost synergies requires a detailed analysis of financials, HR, IT, suppliers, facilities; yet, integrating this data is very difficult.

- Operational Integration: Aligning systems, processes, and teams from two organizations is complex and can disrupt business if not managed carefully.

The Pitfalls of Traditional M&A Analytics

The fragmented approach to M&A analytics leads to several critical problems:

Fragmented Analytics:

- Difficulty in creating side-by-side entity analytics to compare the acquirer and acquiree

- Challenges in developing combined entity analytics to identify synergy opportunities

- Inability to generate integrated analytics for a complete picture across IT, financials, applications, infrastructure, operations, and projects

Shallow Insights:

- Limited ability to drill down from high-level metrics to granular details. For example, knowing overall headcount and cost, but unable to analyze at the individual level

- Difficulty in assessing IT applications / infrastructure and potential synergies. For example, which applications will be used in the target state environment? What are specific opportunities to rationalize IT infrastructure?

Limited Visibility:

- Risk of missing critical factors impacting performance and risk

- Lack of a systematic approach to data collection and integration

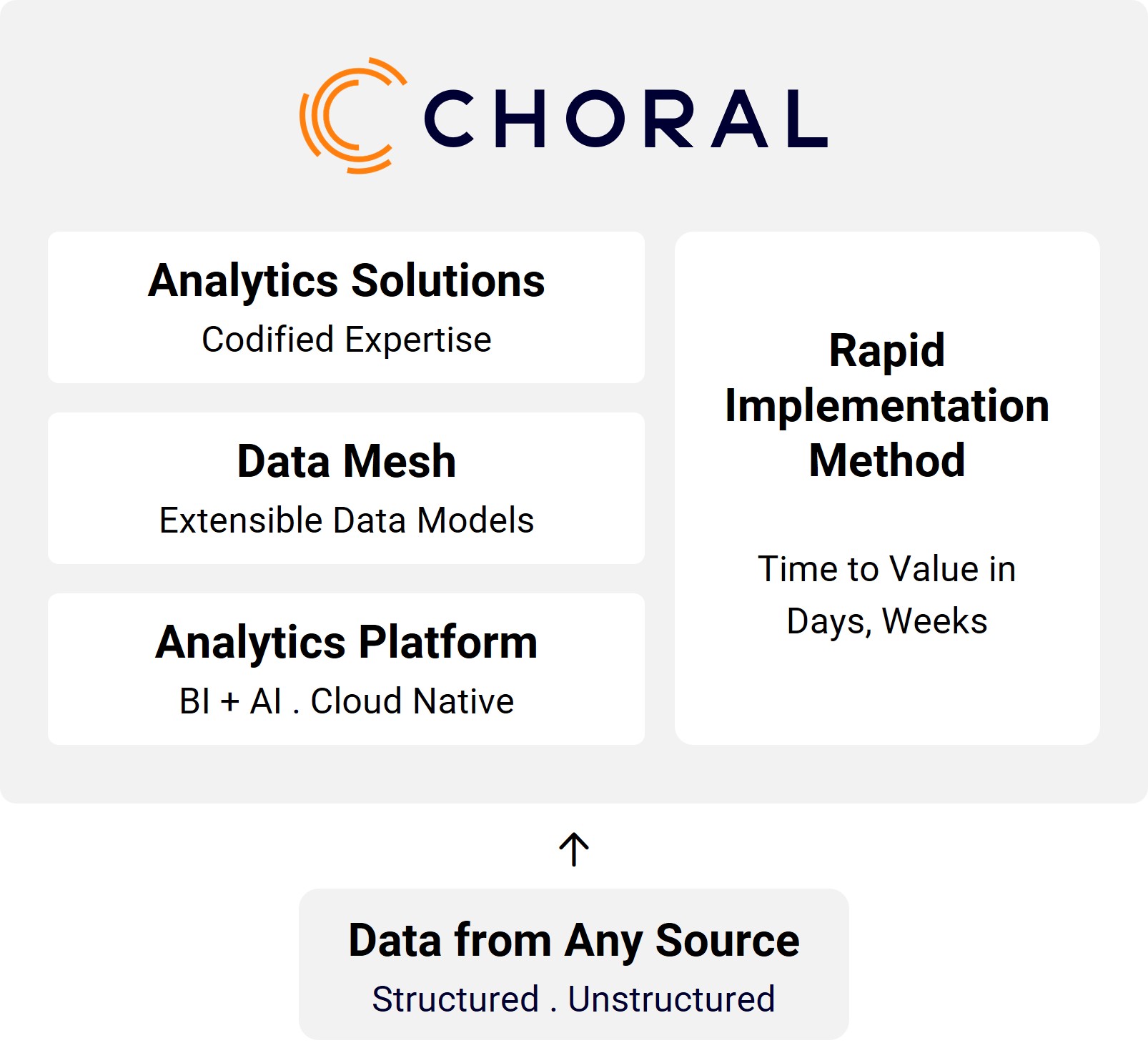

The Choral Difference: Integrated Analytics

Choral Systems has pioneered an approach that addresses these challenges head-on. By creating an integrated fact base and analytics platform, Choral empowers M&A teams to:

- Unify Data: Bring together financial, organizational, technological, operational, project, and risk data from both entities into a single, coherent system.

- Enable Deep Insights: Go beyond surface-level metrics to understand the nuances of each organization and identify true opportunities for synergy.

- Facilitate Collaboration: Provide cross-functional teams with a shared platform for analysis and decision-making.

- Streamline Execution: Monitor integration progress and make data-driven adjustments on the fly.

- Precise Synergy Quantification: Leverage comprehensive data to accurately estimate and track potential synergies, reducing the risk of overestimation or missed opportunities.

- Smooth Operational Integration: Provide a clear view of systems, processes, and teams across both organizations, facilitating seamless alignment and minimizing business disruption.

Real-World Impact

With Choral’s integrated analytics, you can answer critical questions at the click of a button:

- How do the acquirer and acquiree compare across various metrics?

- What are the opportunities for synergies when we combine these two entities?

- What’s the complete picture for IT: financials, applications, infrastructure, operations, and projects for both entities?

- How can we drill down from high-level metrics to individual-level data for deeper analysis?

- Which critical factors might impact performance and risk that we haven’t considered?

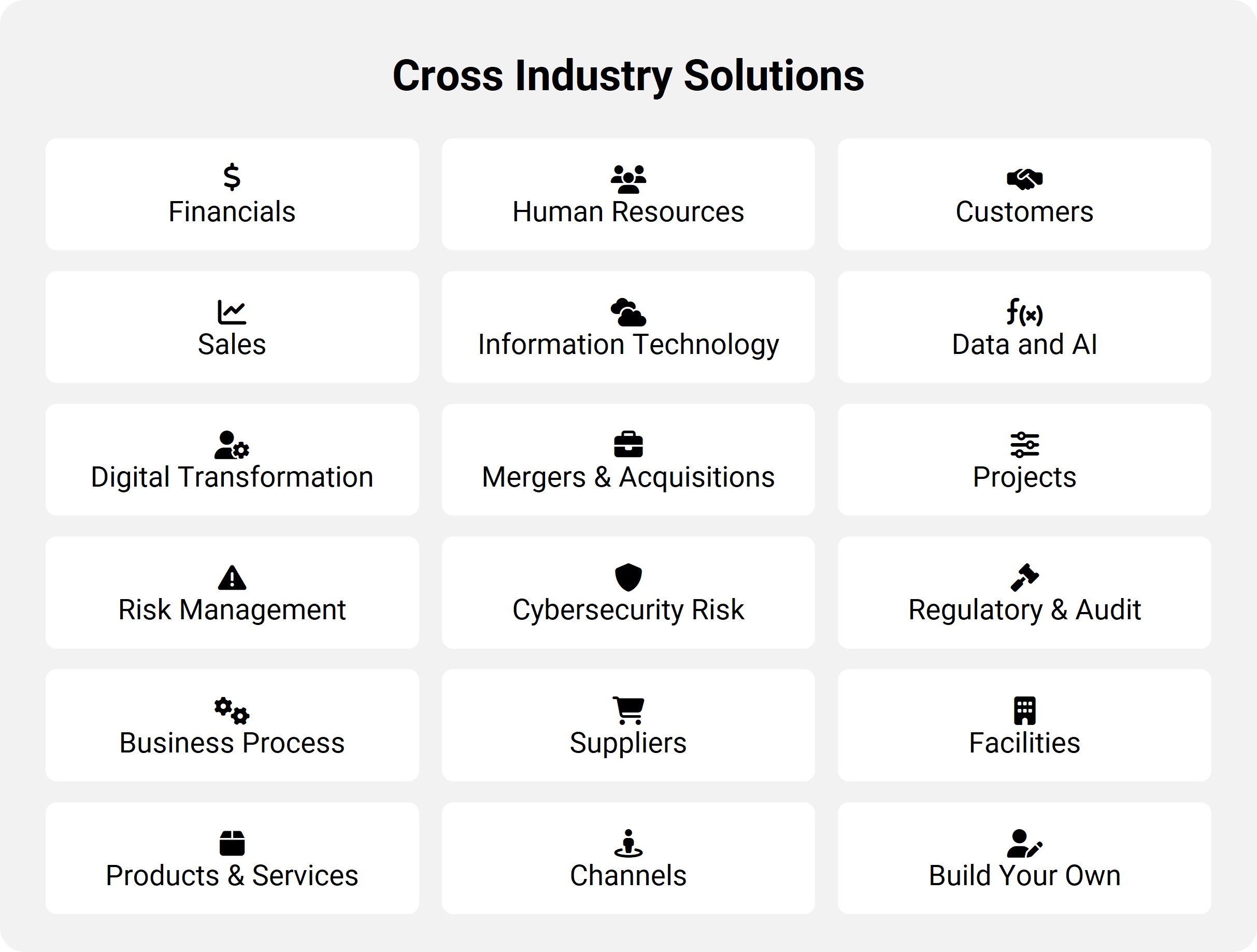

Beyond Traditional Analytics

What sets Choral apart is its holistic approach. Unlike fragmented solutions that provide piecemeal insights, Choral offers a comprehensive view of the entire M&A landscape. This means:

- Side-by-Side Comparisons: Easily analyze the acquirer and acquiree in parallel.

- Combined Entity Projections: Forecast the impact of integration decisions with unprecedented accuracy.

- Cross-Domain Insights: Understand how decisions in one area (e.g., IT) affect others (e.g., operations, finance).

- Synergy Tracking: Monitor and adjust synergy targets based on actual integration progress.

- Integration Roadmap: Visualize and manage the entire operational integration process, from system consolidation to team restructuring.

- Granular Analysis: Drill down from high-level metrics to individual-level data for deeper insights.

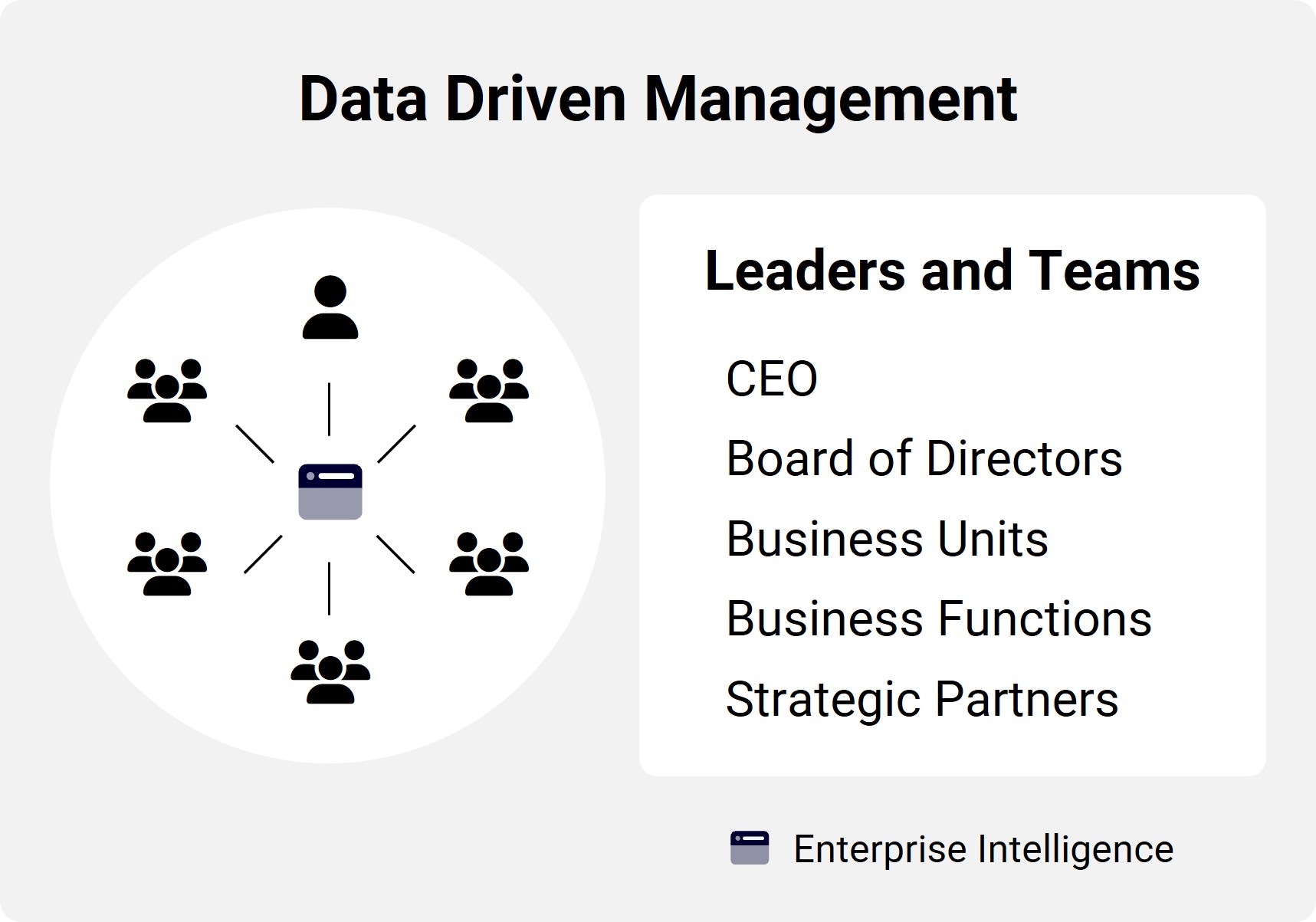

Empowering Business Leaders

For business leaders navigating the complexities of M&A, Choral is more than just a tool – it’s a strategic advantage. By providing clear, actionable insights, Choral empowers you to:

- Make informed decisions faster

- Identify and capitalize on synergies more effectively

- Minimize integration risks and disruptions

- Accelerate time-to-value realization

- Ensure smooth operational integration with minimal business disruption

- Gain comprehensive visibility into all aspects of the M&A process

Take the Next Step

Don’t let data fragmentation and analytical limitations hinder your M&A success. Experience the power of integrated analytics with Choral Systems.

Ready to see how Choral can transform your M&A process? Request a demo today and discover the future of M&A analytics.

Unlock the full potential of your M&A strategy with Choral – where data meets decision, and vision becomes reality.