In the intricate world of banking, risk isn’t just a factor—it’s the ecosystem in which every decision grows. As a banking leader, you’re not just managing accounts and assets; you’re cultivating a complex, interconnected environment where each risk element can influence the entire system.

The Butterfly Effect: Lessons from Silicon Valley Bank

Remember the Silicon Valley Bank (SVB) collapse? It wasn’t just a cautionary tale – it was a stark illustration of the butterfly effect in banking. A seemingly isolated $1.8 billion loss on a bond portfolio set off a chain reaction: a failed capital raise attempt, followed by a devastating bank run. This event revealed a crucial truth: in modern banking, risks are not isolated incidents but interconnected elements in a vast ecosystem. SVB is one example of what can happen when a management team does not fully understand the likelihood and impact of emerging enterprise risks. It underscores the critical importance of comprehensive risk management in today’s complex financial landscape.

The Risk Biodiversity: More Than Meets the Eye

Seasoned banking leaders are well-versed in the common types of risk: credit, market, liquidity. But today’s risk landscape is more complex, volatile and uncertain than ever.

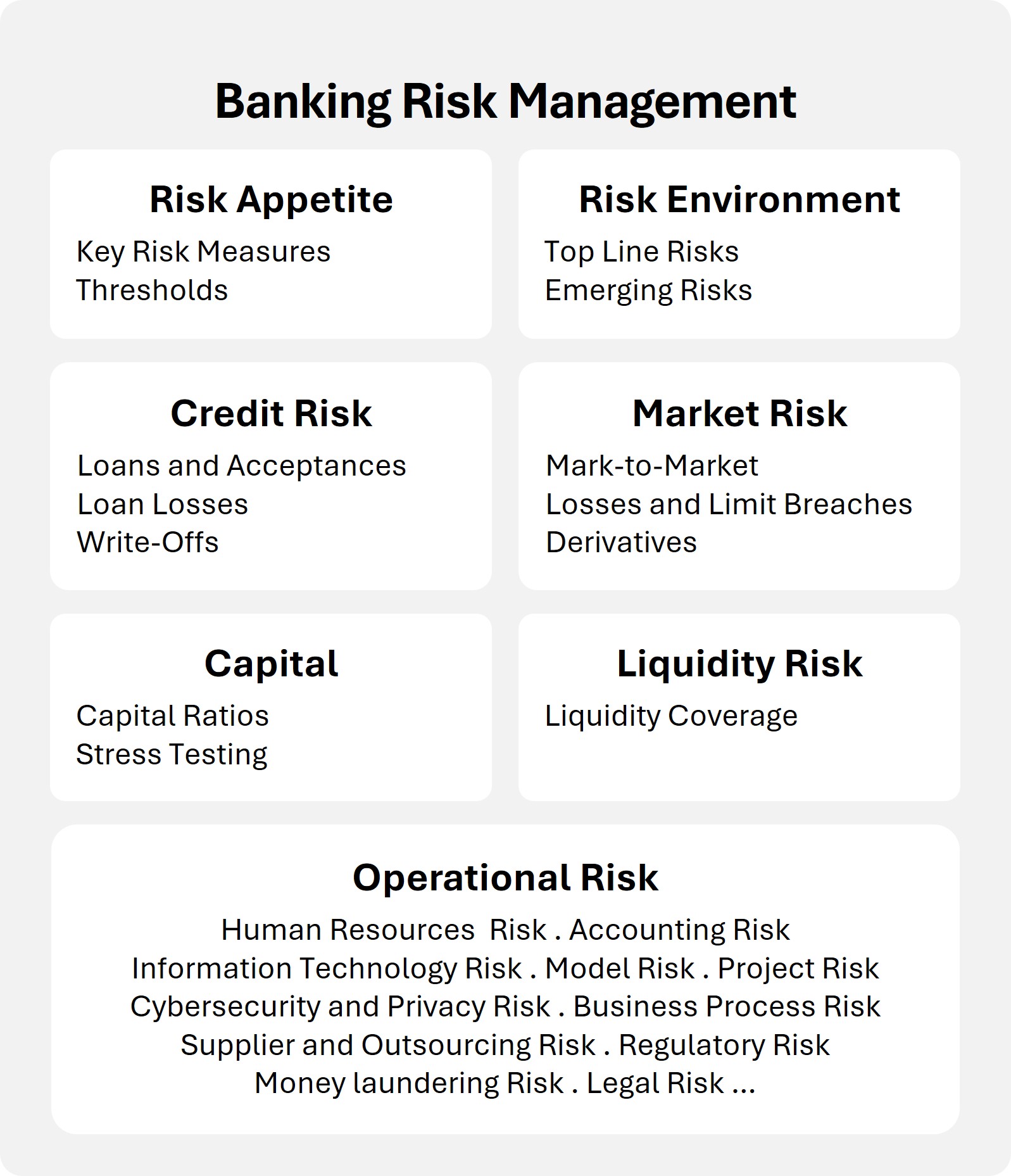

- Risk Appetite

This is the amount of risk the bank is willing to accept to achieve its goals. It is translated in a set of metrics and thresholds which are closely monitored by the risk management committee. - Risk Environment

The risk environment is typically divided into top line risk and emerging risks. These risks may include geopolitical factors (war, trade conflicts), macroeconomic risks (interest rates, inflation, unemployment), competitive risks (Fintech), and technology (cybersecurity, AI). - Credit Risk

The possibility that a borrower or counterparty will not fulfill their obligations, such as failing to repay a loan, mortgage, or credit card. A wide variety of metrics and analytics are used to ascertain credit risk. - Market Risk

Market risk is the risk of losses in positions arising from movements in market variables like prices and volatility. Here again, numerous metrics and analytics are used to monitor this type of risk including interest rate risk, value at risk, mark-to-market losses, available for sales securities, and derivative instruments. - Capital

A strong capital position is critical. Capital ratios are monitored, and stress tests are conducted to assess the impact of certain scenarios on the bank’s capital position. - Liquidity Risk

Liquidity risk is the risk that the bank will be unable to meet its financial obligations when they come due. This can happen if the bank doesn’t have enough cash or can’t easily convert assets into cash. The Silicon Valley Bank example illustrates how a market risk issues (mark-to-market loss) led to capital inadequacy which in turn led to a liquidity crisis (run on the bank). - Operational Risk

Operational risk is the risk of loss that can result from ineffective or failed internal processes, people, systems, or external events that disrupt a business’s operations. In today’s digital world, operational risk is one of the most significant risks for banks. Specifically, IT risk, cybersecurity risk, and financial crimes such as fraud and now AI related risks pose a significant challenge for a bank’s management team.

The Monoculture Approach: Why It’s No Longer Sustainable

If you’re relying on siloed risk management strategies and fragmented data systems, you’re practicing monoculture in an era that demands biodiversity. The SVB collapse demonstrated that even robust individual risk management practices can fall short when risks interact in unexpected ways.

A New Paradigm: Integrated Risk Management

What if you could see your bank’s entire risk landscape as a living, breathing ecosystem? What if you could not only identify individual species of risk but understand how they interact and influence the entire environment? This is where integrated analytics comes into play.

Imagine a comprehensive ecological survey for your bank’s risk management:

- Holistic View: No more isolated observations. See how changes in one area relate to the bank overall.

- Timely Monitoring: Spot emerging threats before they disrupt the business.

- Data-Driven Collaboration: Break down departmental silos and promote a culture of collective risk management.

Evolving Your Risk Ecosystem: Four Transformational Improvements

To thrive in this complex environment, your risk management approach needs to adapt, grow, and become more sophisticated.

Choral Systems has identified four key transformational improvements that can revolutionize your risk management ecosystem. These enhancements work together to create a more resilient, responsive, and intelligent risk management approach:

- Improved Collaboration

- Codified Expertise in a Library of Analytics Solutions

- Organized and Connected Data

- Step-by-Step Method for Fast and Efficient Implementation

Each of these improvements acts like a catalyst in your risk ecosystem, spurring growth, promoting resilience, and enabling your bank to navigate the complex world of financial risk with unprecedented agility and insight. Let’s explore each of these transformational elements in detail.

1) Cultivating Collaboration: The Key to a Thriving Risk Ecosystem

In nature, the healthiest ecosystems are those with the most diverse and interconnected species. The same principle applies to your bank’s risk management. Given the complexity and interconnectedness of risks across a bank, cross-functional and cross-business unit collaboration isn’t just beneficial – it’s essential for effective risk identification and mitigation.

Breaking Down Silos: Creating a Unified Risk Biosphere

Imagine a risk management approach that doesn’t just provide insights but creates a collaborative environment that drives real change. This is where integrated analytics comes into play, offering a ‘single pane of glass’ through which all stakeholders can view and manage risks.

Here’s how this integrated approach transforms your risk ecosystem:

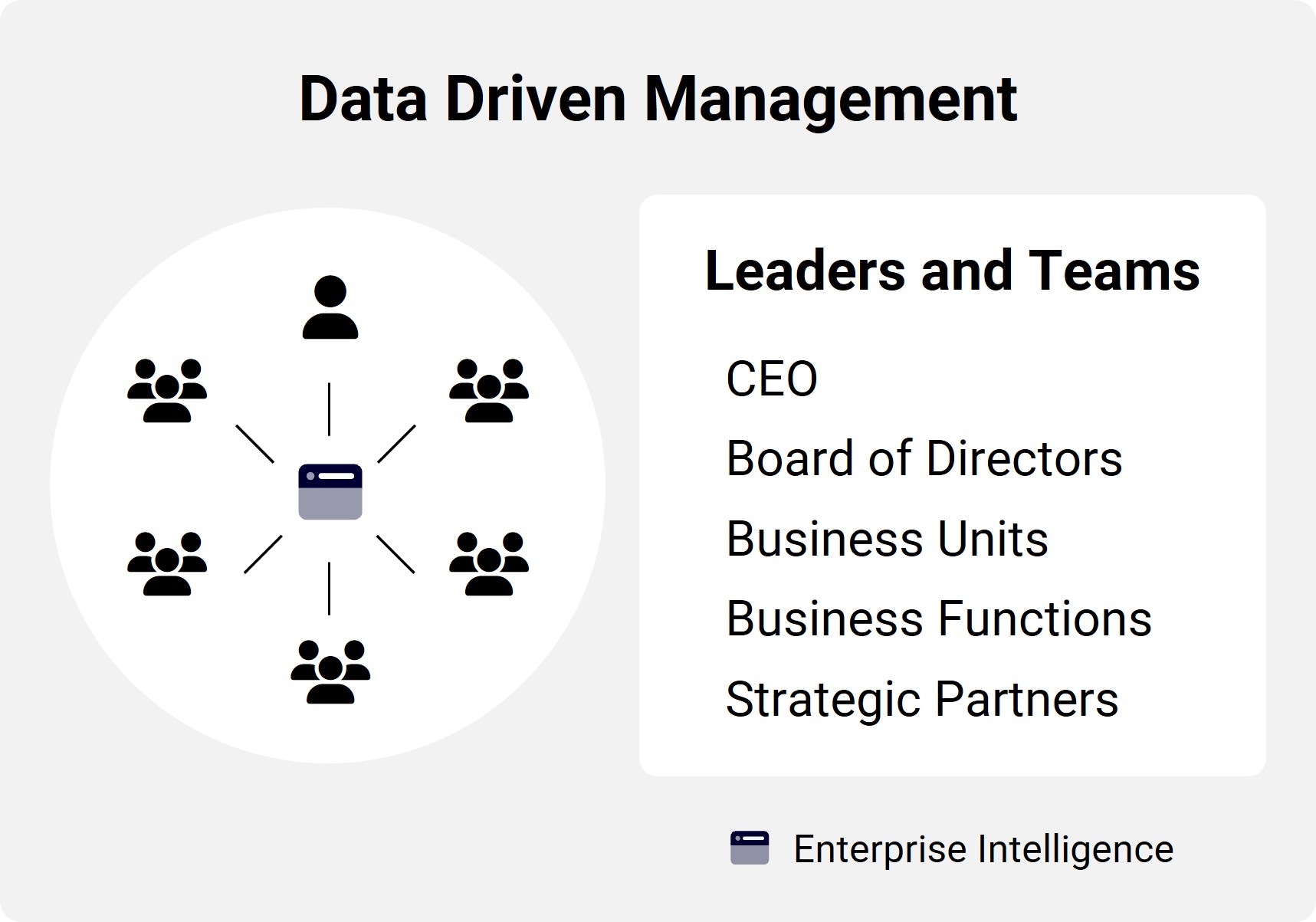

- Unified Perspective: Just as all species in an ecosystem share the same environment, all stakeholders—from risk management to business units, technology, operations, and corporate functions—work from the same set of data and insights. This shared view eliminates discrepancies and aligns priorities and actions.

- Timely Decision Making: In nature, quick reactions can mean the difference between survival and extinction. With up-to-date information at their fingertips, your teams can make informed decisions swiftly, responding to risks as they emerge.

- Cross-Functional Insights: Ecosystems thrive on symbiotic relationships. Our platform allows users to easily explore connections between different risks, uncovering issues that might be missed in a siloed approach—much like how ecologists discover new relationships between species.

- Transparent Communication: Clear communication is vital in any ecosystem. The shared analytics environment facilitates transparent communication of goals, progress, and outcomes across all levels of the organization, ensuring everyone is speaking the same language.

- Empowered Teams: By democratizing access to data and insights, we empower teams at all levels to contribute to risk management initiatives. This is akin to how each species in an ecosystem plays a crucial role in maintaining balance, creating a culture of continuous improvement.

- Streamlined Meetings: With all relevant data readily available, meetings become more productive, focused on strategic decisions rather than debating numbers. It’s like having a comprehensive field guide at your fingertips during an ecosystem survey.

Catalyzing Real Change

By augmenting collaboration through integrated data and analytics, this approach doesn’t just provide insights—it catalyzes action. It ensures that risks are not just identified but that appropriate management actions are taken swiftly and effectively.

2) Leveraging Codified Expertise

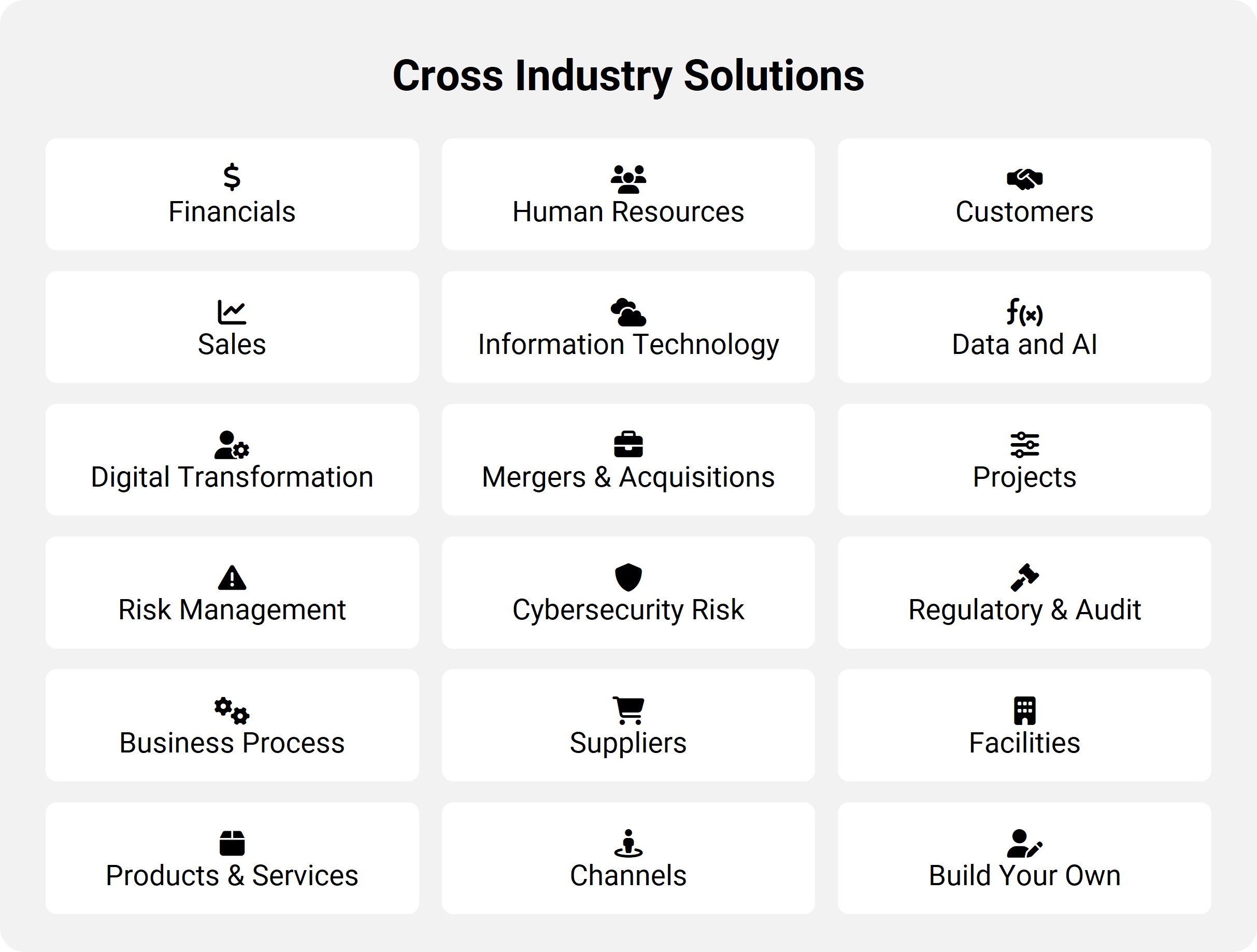

In any complex ecosystem, having a comprehensive field guide is invaluable. It allows you to quickly identify species, understand their behaviors, and make informed decisions. In the world of banking risk management, our library of analytics solutions serves as this essential field guide.

Pre-built Wisdom: Your Risk Management Companion

Imagine having a team of expert risk ecologists at your disposal, each specializing in a different aspect of your financial ecosystem. That’s exactly what our pre-built, customizable applications offer. These solutions provide immediate value and can be implemented based on your specific priorities, delivering insights across a wide range of risks.

Each module in our library is like a chapter in your field guide, designed to deliver specific insights that improve risk management in its respective domain. Whether you’re dealing with credit risk, operational risk, IT risk, cybersecurity risk, digital/AI transformation risk, or financial crimes risk, we have a specialized tool to help you navigate the terrain.

The Power of an Integrated Approach

Just as a comprehensive understanding of an ecosystem requires knowledge of all its interconnected parts, our integrated approach to risk management offers a holistic view of your bank’s risk landscape. Here’s how this empowers your organization:

- Panoramic Risk View: Gain a 360-degree perspective of risks across your bank, much like viewing your financial ecosystem from a mountaintop.

- Swift Action Targeting: Quickly focus on the appropriate management actions, allowing you to address risks with the precision of a skilled naturalist.

- Initiative Tracking: Monitor the execution of risk management initiatives, ensuring your efforts to maintain balance in your financial ecosystem are on track.

- Cross-Pollination of Ideas: Build data-driven collaboration across departments, enabling the free flow of insights and strategies, much like the symbiotic relationships in a thriving ecosystem.

Adaptability Meets Expertise

While our solutions come pre-built with industry best practices and regulatory requirements in mind, they’re not rigid structures. Like a field guide that allows for new observations and notes, our applications are customizable to fit the unique contours of your bank’s risk landscape.

This blend of codified expertise and adaptability ensures that you’re always equipped with the most relevant and up-to-date risk management tools, ready to face both familiar challenges and emerging threats in your financial ecosystem.

By leveraging this library of analytics solutions, you’re not just managing risks—you’re gaining a deeper understanding of your entire banking ecosystem. You’re equipped to not only identify potential threats but to seize opportunities for growth and innovation.

3) Organized and Connected Data

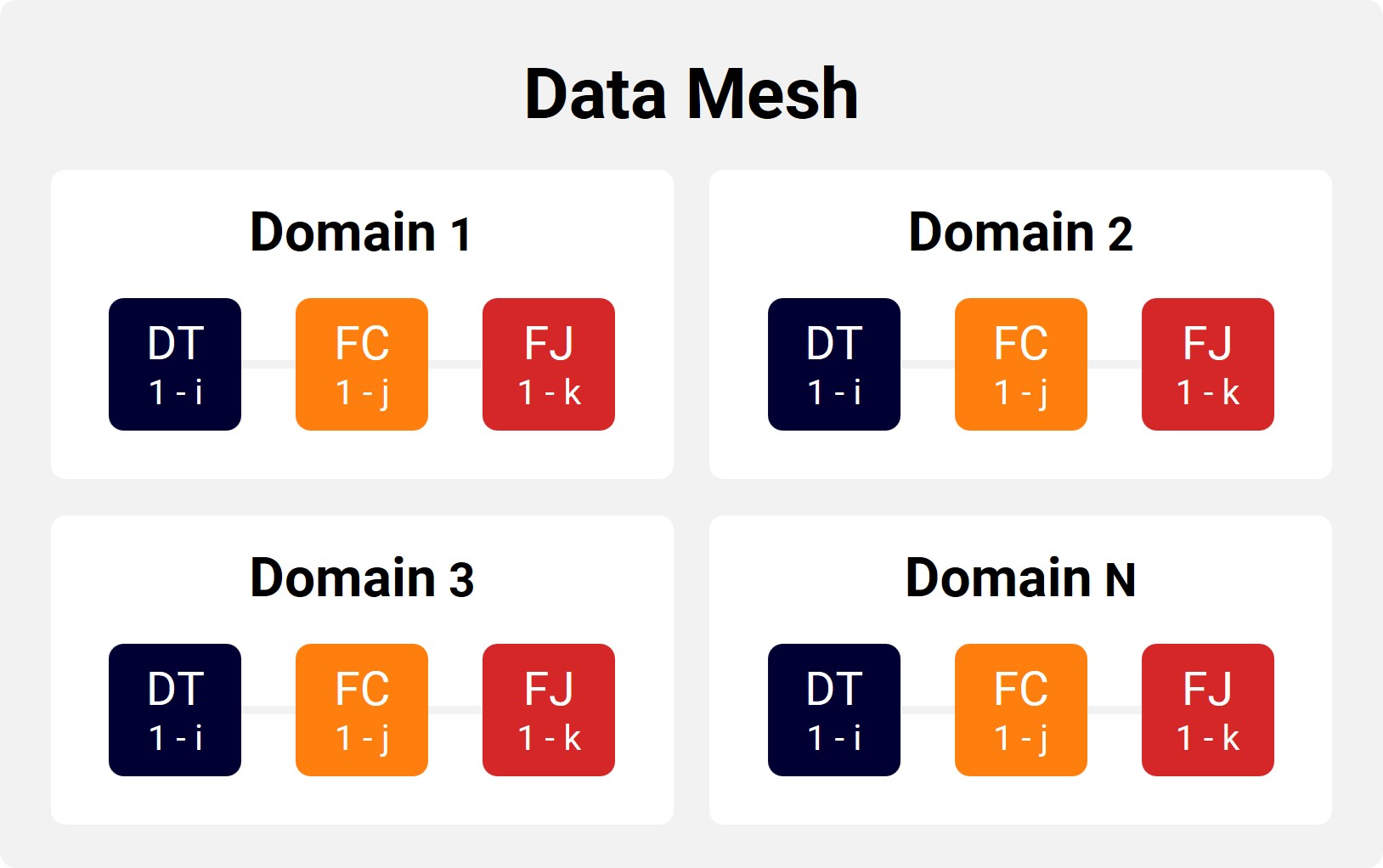

At the heart of any thriving ecosystem is a complex network of connections. In your bank’s risk management ecosystem, this network is brought to life through our sophisticated Data Mesh architecture.

Think of the Data Mesh as the neural network of your risk ecosystem—organizing and interconnecting structured and unstructured data from any source, making it truly actionable. This is where many banks struggle, as it requires close collaboration between domain experts and data architects. Getting this right is both critical and challenging.

The Choral Data Mesh is a pre-built, extensible logical and physical data model. It’s a common language that facilitates collaboration between business leaders, functional leaders, and data teams. Here’s why it’s a game-changer:

- Rapid Data Integration: Quickly “wire up” the data needed for effective risk management.

- Cross-Functional Insights: Break down silos for a holistic view of risks across the bank.

- Seamless Application Integration: Works in harmony with our applications library for fast implementation and superior insights.

- Scalability and Flexibility: Grows with your bank, adapting to changing market conditions.

- Empowering Data Ownership: Promotes data responsibility and faster decision-making at all levels.

By leveraging this advanced Data Mesh architecture, your bank can transform raw data into actionable intelligence, responding to risks with unprecedented speed and precision. It’s like giving your risk ecosystem a supercharged nervous system, enabling it to react swiftly and intelligently to any threat or opportunity.

4) Fast-Tracking Your Risk Management Transformation

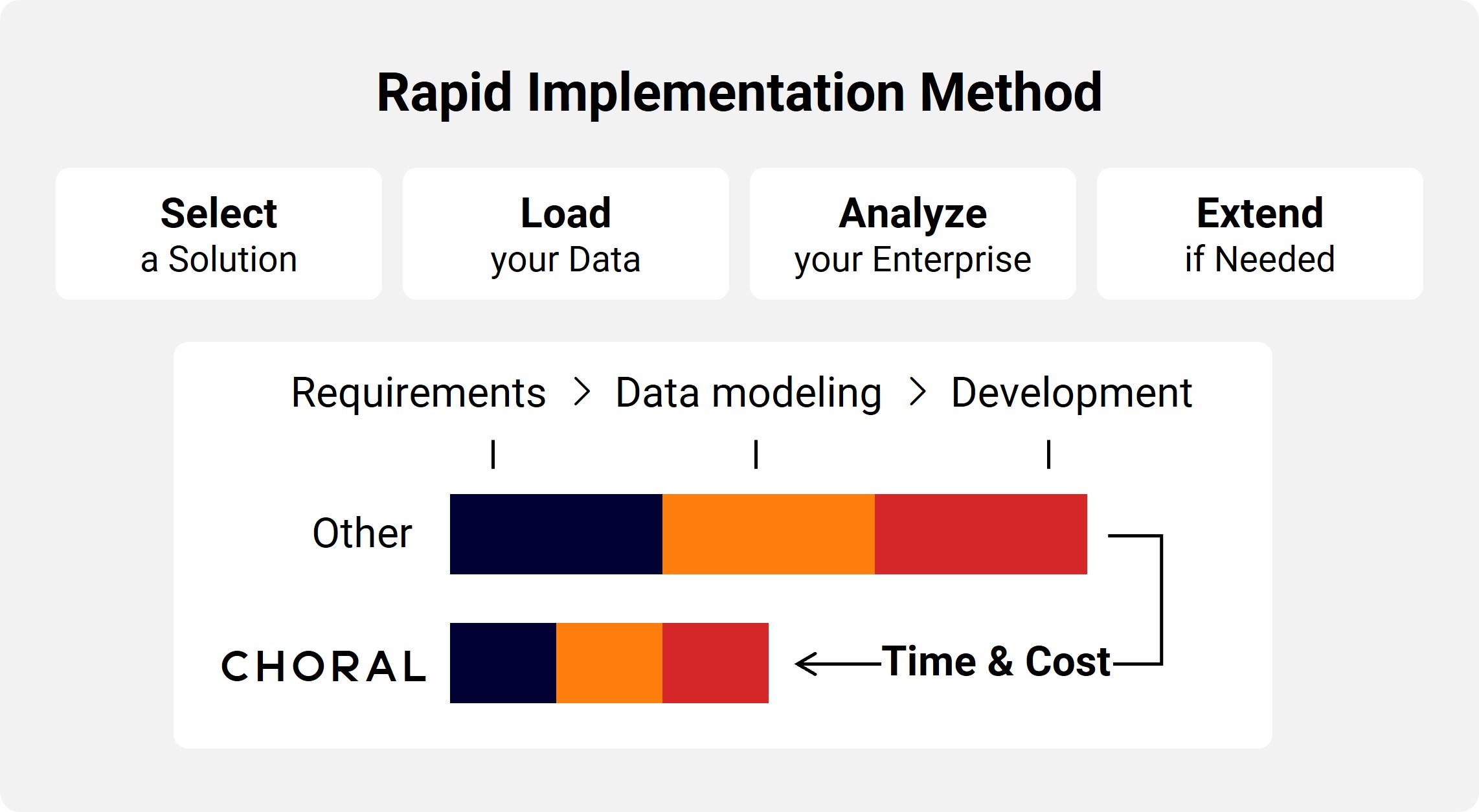

In nature, the ability to adapt quickly can mean the difference between thriving and extinction. The same is true in the banking risk ecosystem. This is where Choral’s Rapid Implementation Method becomes your evolutionary advantage.

What sets Choral apart isn’t just our technology, but our methodology. Our approach enables banks to deploy solutions up to 10 times faster and at a fraction of the cost compared to traditional methods. It’s like compressing years of ecosystem evolution into mere months.

By combining cutting-edge technology with deep industry expertise, we empower banks to:

- Enhance risk management with instant access to high-value data and analytics

- Foster data-driven collaboration through a holistic view of enterprise risks

- Quickly gain insights into issues requiring attention

- Stay agile in the face of rapid change

This method doesn’t just implement technology – it catalyzes a rapid evolution in your risk management capabilities. It’s your fast track to a more resilient, responsive, and intelligent risk ecosystem.

The Power of Integrated Analytics

Here’s how an integrated approach can transform your risk management:

- Early Warning System: Detect subtle changes in your risk ecosystem before they become major disruptions.

- Scenario Planning: Run “what-if” analysis to prepare for various environmental changes.

- Resource Optimization: Allocate your risk management resources more effectively, like a carefully balanced ecosystem.

- Regulatory Adaptation: Stay ahead of regulatory requirements with comprehensive, readily available risk data.

- Strategic Evolution: Use risk insights to inform strategic decisions, turning risk management from a defensive measure into an evolutionary advantage.

The Human Element: Your Risk Ecologists

While technology is crucial, remember that your greatest asset in risk management is your team. Integrated analytics isn’t about replacing human judgment—it’s about enhancing it. By providing your risk managers with comprehensive, real-time data and insights, you’re empowering them to be expert ecologists of your financial ecosystem.

The Path Forward: Cultivating a Resilient Risk Ecosystem

The banking landscape will continue to evolve, and with it, the nature of risk. But by adopting an integrated approach to risk management, you’re not just adapting to change—you’re cultivating a more resilient ecosystem.

Are you ready to transform how your bank understands and manages its risk ecosystem? The tools exist today to give you a clearer, more comprehensive view of your risk landscape than ever before. By embracing this new paradigm, you can turn risk management from a necessary evil into a strategic advantage.

In the end, effective risk management isn’t just about preventing ecosystem collapse—it’s about creating an environment where your bank can thrive. With the right approach, you can cultivate a diverse, resilient, and prosperous financial ecosystem.

Ready to become a master of your bank’s risk ecosystem? The future of banking is here, and it’s more intelligent, integrated, and insightful than ever before.