In the high-stakes world of private equity, where every decision can mean millions in returns, how do you stay ahead of the curve? As competition intensifies and markets become increasingly complex, the key to unlocking unprecedented value lies in harnessing the power of integrated data and analytics. At Choral, we’ve pioneered a transformative approach that’s reshaping how PE firms operate, make decisions, and drive value creation.

Why This Matters: The Private Equity Challenge

Leading a private equity firm in today’s landscape is akin to conducting a complex symphony of moving parts:

- Managing a dynamic pipeline of acquisitions and divestitures

- Operating a diverse portfolio spanning multiple industries

- Accurately valuing entities for purchase and sale

- Driving effective operation and transformation to unlock business value

- Identifying and realizing synergies across portfolio companies

Each of these challenges demands precision, speed, and insight. But here’s the critical question: How can PE firms achieve this level of performance consistently across their entire portfolio?

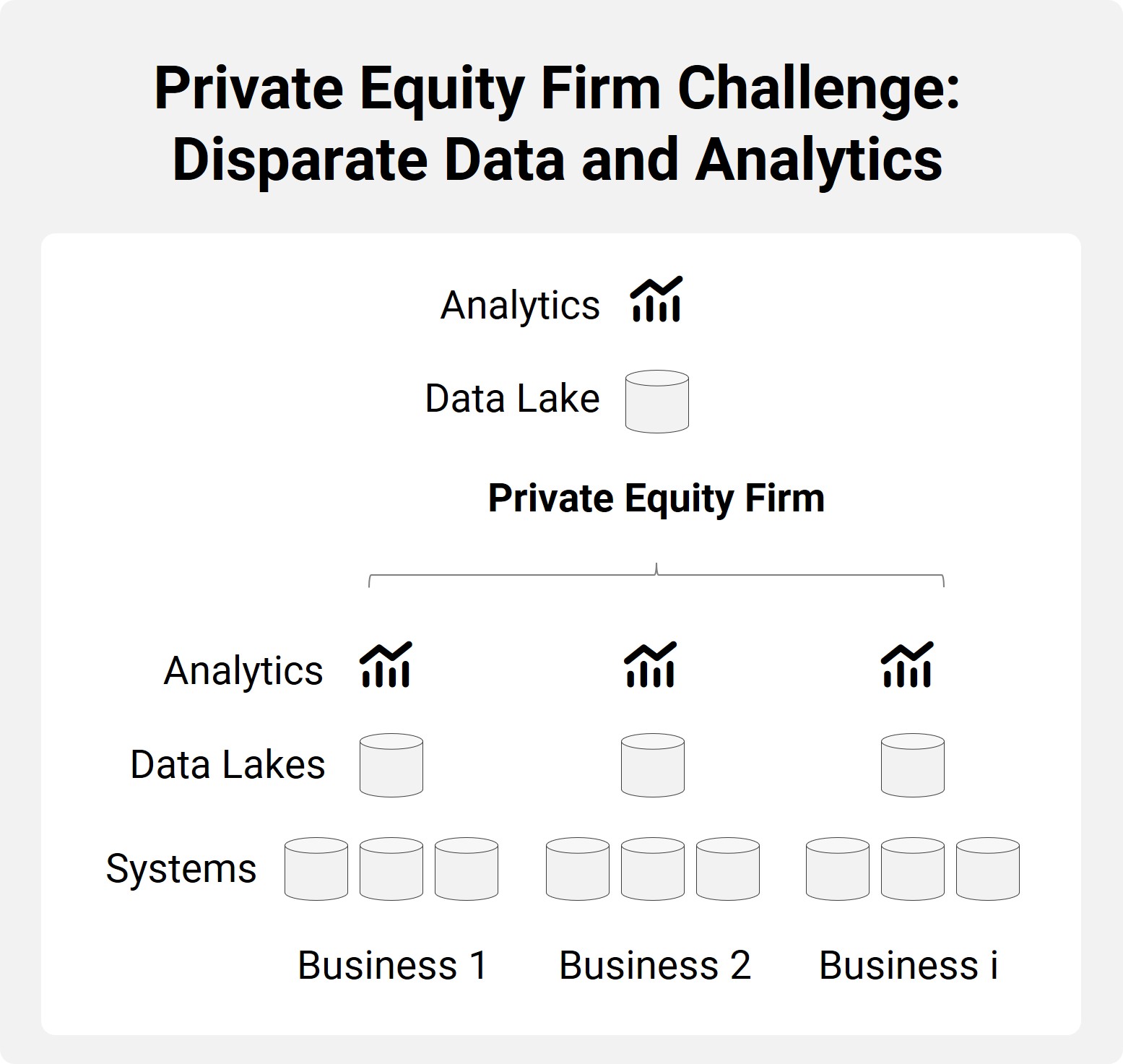

The Data Dilemma in Private Equity

The answer lies in data and analytics, but it’s not that simple. PE firms face a unique challenge:

- Constant Change: With new companies constantly entering the portfolio, each bringing its own set of reports, analytics, and IT systems, creating a unified view seems nearly impossible.

- Integration Hurdles: Agreeing on target state reports and analytics is just the beginning. The real challenge lies in “wiring up” the data to make it happen.

- Partial Visibility: As a result, PE leaders often find themselves managing with incomplete insights, potentially missing critical opportunities or risks.

This is where Choral’s revolutionary approach comes into play.

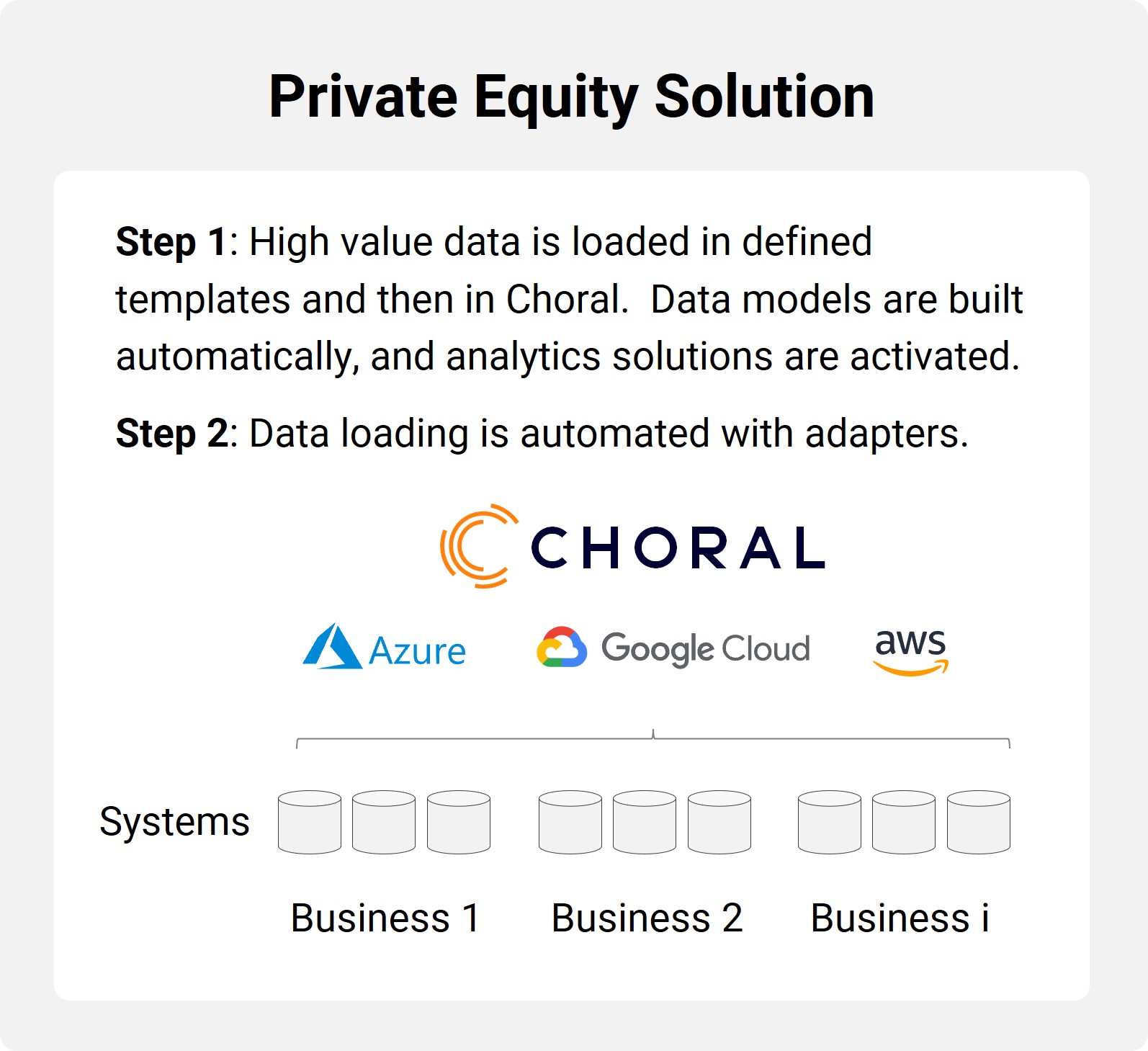

Choral’s Solution: A Next-Gen Data-Driven Operating Model

Imagine having a comprehensive, unified view of your entire portfolio at your fingertips. Choral’s integrated analytics platform makes this a reality with:

1. Pre-built Analytics Solutions: Tailored specifically for PE firm management, covering everything from M&A to risk management.

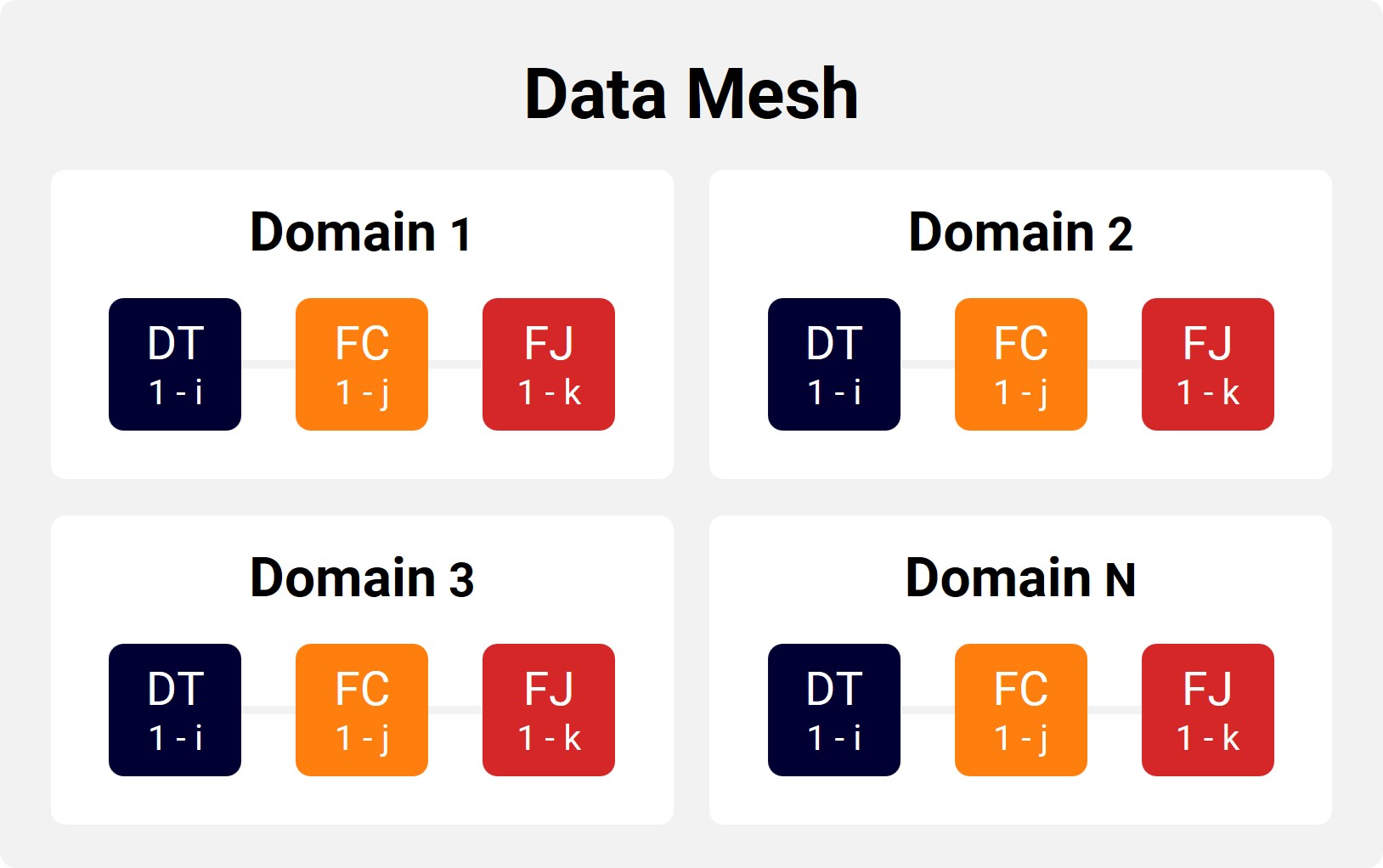

2. Extensible Data Models: Powerful, flexible models that can adapt to your unique portfolio needs.

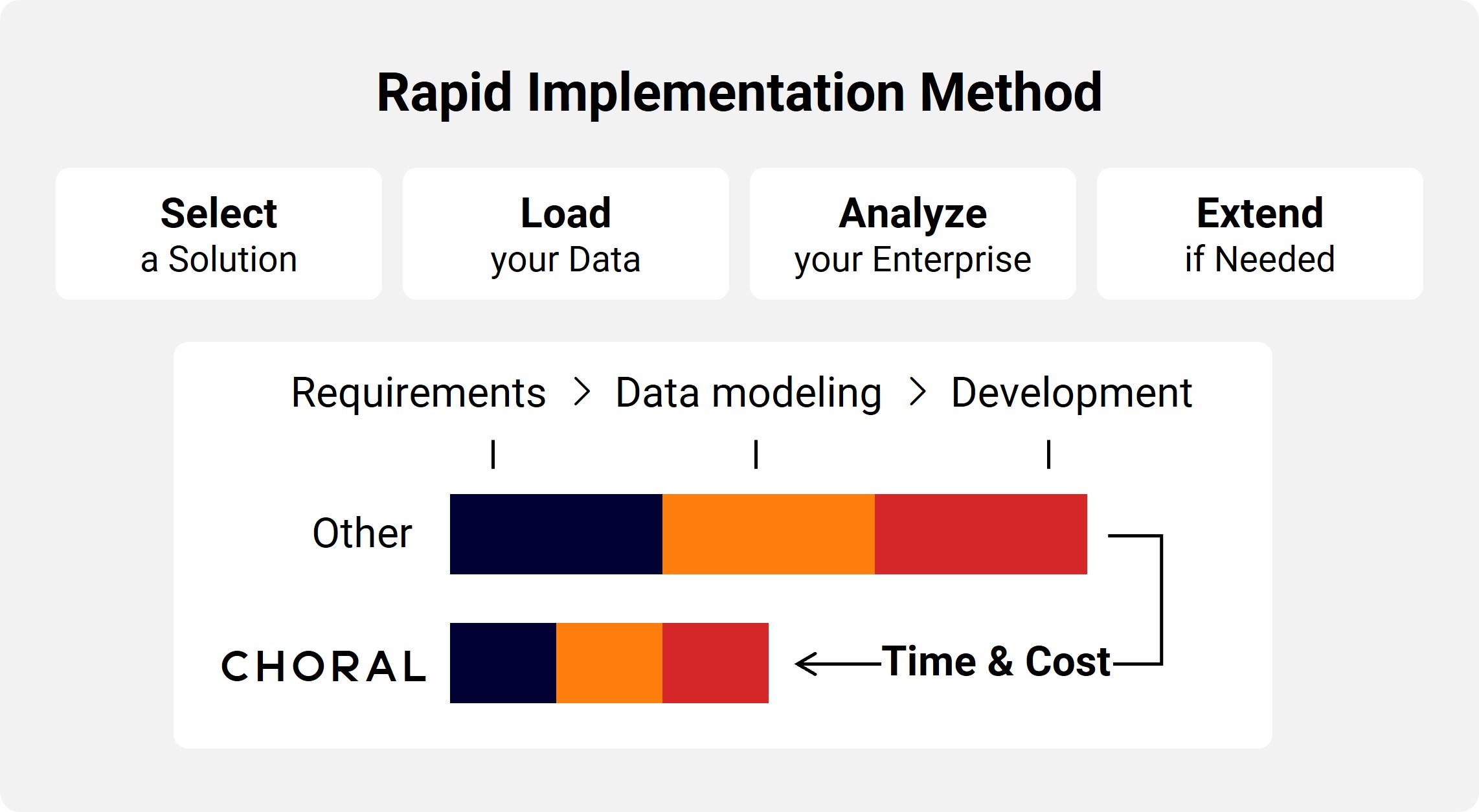

3. Rapid Implementation Method: A step-by-step approach to quickly “light up” solutions across your portfolio.

The result? Speed, agility, and unprecedented insights that drive success:

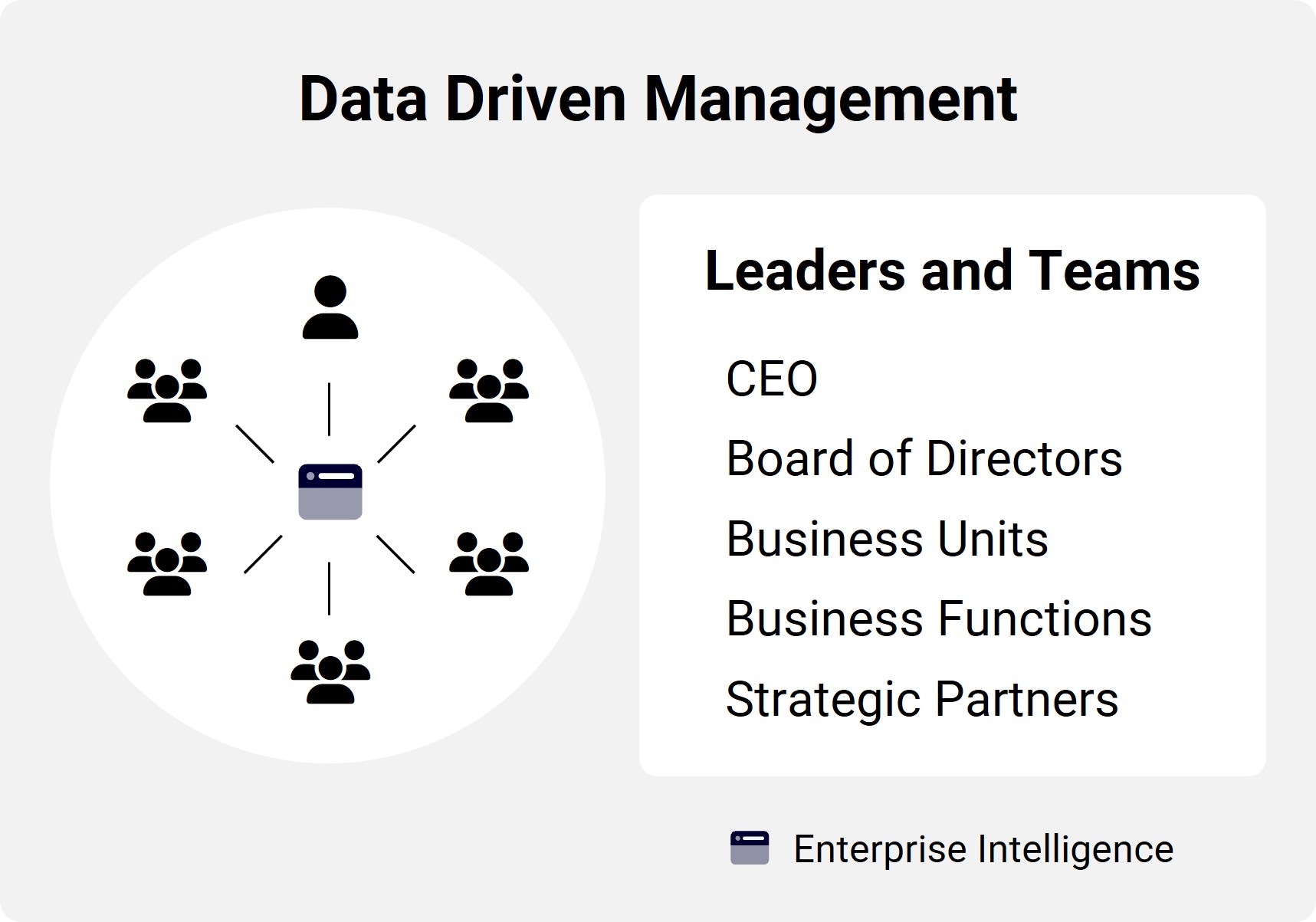

- Unified Portfolio View: PE leaders gain a holistic view of financials and operations across all portfolio companies.

- Aligned Management: Portfolio company leaders operate with metrics and analytics that align perfectly with PE firm expectations.

- Efficient Onboarding: New acquisitions are integrated quickly, with standardized data and analytics from day one.

- Cross-Portfolio Insights: Trends, issues, and synergies become visible across the entire portfolio, unlocking new value creation opportunities.

Transforming Private Equity Operations

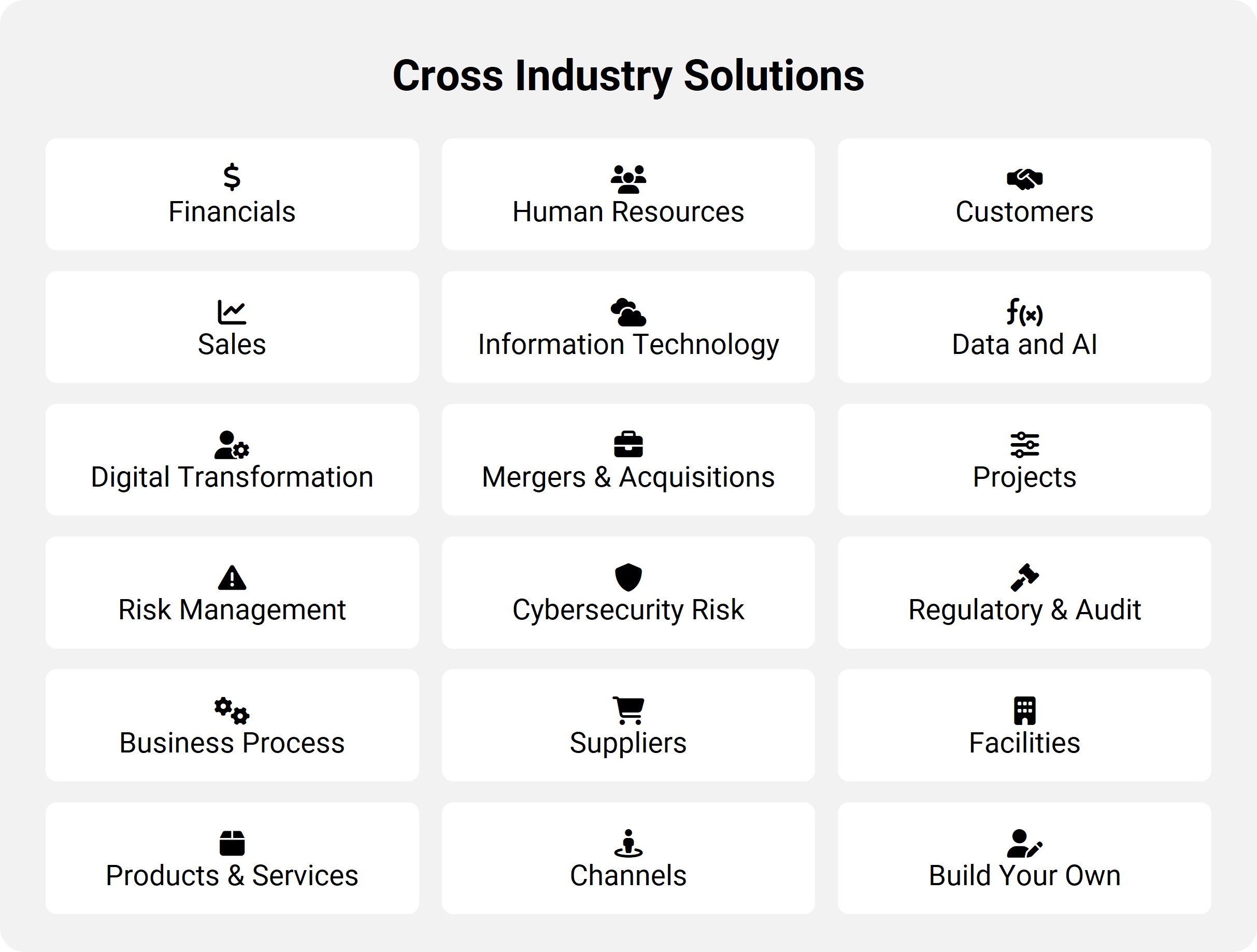

Choral’s platform doesn’t just provide data – it delivers a next-generation, data-driven operating model for PE firms. This model encompasses:

- M&A Analytics: Track pipeline, status, company financials, and profiles with precision.

- Financial Performance Management: Monitor income statements, revenue, OpEx, growth, and profitability across business units.

- Organizational Effectiveness: Optimize structure, headcount, costs, and resource allocation.

- Operational Efficiency: Manage performance and streamline supplier spend, information technology costs, business processes, and facilities.

- Revenue Growth: Analyze sales, customers, products, channels, and marketing effectiveness.

- Risk Management: Monitor audit issues, regulatory compliance, IT risks, and cybersecurity.

The Choral Advantage: Why It Matters

By adopting Choral’s integrated data and analytics approach, PE firms gain:

- Competitive Edge: Make faster, more informed decisions in a market where speed and accuracy are critical.

- Value Creation Acceleration: Identify and capitalize on opportunities for growth and efficiency across the portfolio.

- Risk Mitigation: Spot potential issues before they become problems, protecting your investments.

- Operational Excellence: Drive consistent, best-in-class operations across all portfolio companies.

- Strategic Agility: Adapt quickly to market changes and new opportunities, staying ahead of the competition.

Conclusion: The Future of Private Equity is Data-Driven

In an era where data is king, Choral’s integrated analytics platform isn’t just an advantage – it’s a necessity for PE firms aiming to lead the market. By transforming how PE firms collaborate with management teams across their portfolio, Choral’s solution paves the way for greater business performance and value creation.

Are you ready to revolutionize your private equity operations and unlock unprecedented value? Discover how Choral’s integrated analytics platform can transform your firm’s performance. Contact us today to start your journey towards data-driven PE excellence.